Ceybank Century Growth Fund : Equity Fund

| Fund Facts at a Glance | |

|---|---|

| Fund Type | Growth – Open Ended |

| Investment Objective | Growth of Capital |

| Invests in | Equity Securities |

| Dividends | At managers discretion |

| Risk | Moderately High |

| Taxation | Refer Government Tax policy |

| Trustee | National Savings Bank |

| Custodian | Bank of Ceylon |

| Management Fees | 1.650% P.A |

| Trustee Fees | 0.250% P.A |

| Custodian Fees | 0.085% P.A |

| Front End Fee | 3% |

| Exit Fee | Nil |

| Minimum initial Investment | Rs 1,000/- |

| Currency | Sri Lanka Rupees (LKR) |

| Start date | 22nd January 1997 |

Introduction

Ceybank Century Growth Fund is the first equity Fund launched under Growth Fund category in Sri Lanka and the second Fund floated by Ceybank AML. Ceybank Century Growth Fund has become the second largest Unit Trust in the Growth Fund category in Sri Lanka with more than 1,700 unit holders, in line with sister Fund's leading position in the Income and Growth Fund category.

Objective

To achieve long term capital appreciation by investing in a diversified portfolio predominantly with equity securities listed on Colombo Stock Exchange with strong growth potential

Style

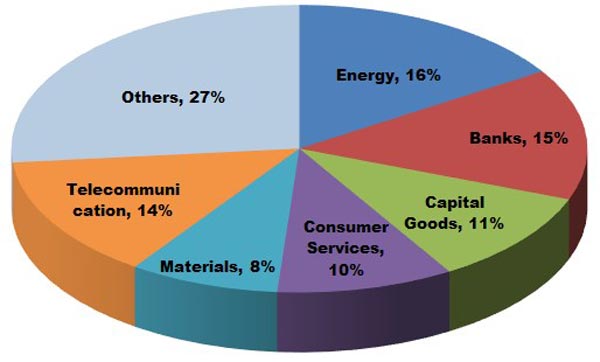

The Fund Manager adopts an active portfolio strategy which places particular emphasis upon large capitalized companies that are positioned for long term growth. The Fund strives to diversify the equity investments across economic sectors and individual securities in order to reduce the risk of high exposure to a specific sector or stock.

Risk factors

Investing in Sri Lankan equity include risks normally associated with investing in shares as well as political and economic uncertainties unique to Sri Lanka. Accordingly the unit prices can fluctuate according to the value of underlying investments. Since the investments are denominated in Sri Lanka Rupees, the investors of other currencies will have to bear the risk of currency fluctuations.

Taxation

Taxes payable by the Fund & the Investor will be based on the prevailing Government tax policy

Dividend

Dividend payable by the Fund is at the discretion of the manager

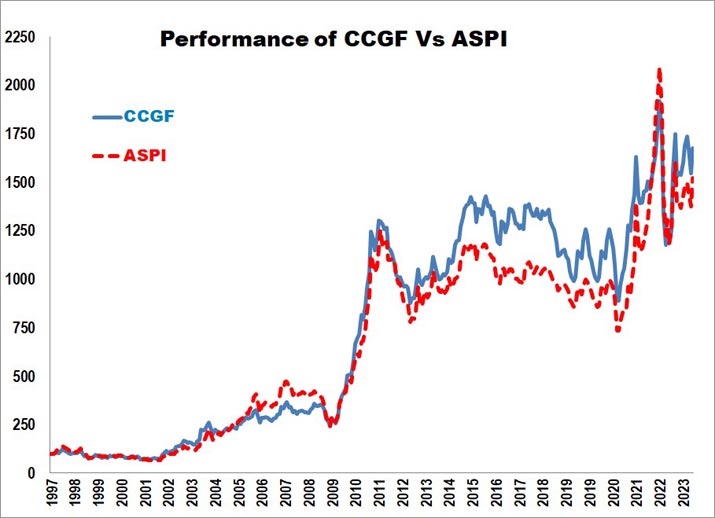

Performance of CCGF VS All Share Price Index (ASPI) since launch

DIVERSIFICATION OF THE EQUITY PORTFOLIO

TOP TEN EQUITY HOLDINGS (Alphabetical Order) - CENTURY GROWTH FUND

| Company |

|---|

| ASIAN HOTELS & PROPERTIES PLC |

| DIALOG AXIATA PLC |

| JOHN KEELLS HOLDINGS PLC |

| HATTON NATIONAL BANK PLC - N/V |

| KELANI TYRES PLC |

| LANKA HOSPITALS CORPORATION PLC |

| LANKA IOC PLC |

| SAMPATH BANK PLC |

| SRI LANKA TELECOM PLC |

| TOKYO CEMENT COMPANY PLC - N/V |

CCGF Fund Performance based on NAV

| Simple Rate | ||

|---|---|---|

| Period | CCGF | ASPI |

| 2022 | -15.55% | -30.56% |

| 2021 | 27.00% | 80.48% |

| 2020 | 17.28% | 10.52% |

| 2019 | 5.87% | 1.27% |

| 2018 | -11.93% | -4.98% |

| 2017 | 1.73% | 2.26% |

| 2016 | -4.54% | -9.66% |

| 2015 | -5.25% | -5.54% |

| 2014 | 36.88% | 23.44% |

| 2013 | 4.64% | 4.78% |

| 2012 | -1.78% | -7.10% |

| 2011 | -16.69% | -8.46% |

| 2010 | 106.11% | 96.01% |

*Percentage change in

NAV as at end December Adjusted for

dividends.

** ASPI - Colombo Stock Exchange All Share Price Index