Ceybank Unit Trust : Income and Growth Fund

| Fund Facts at a Glance | |

|---|---|

| Fund Type | Income and Growth Fund |

| Investment Objective | Income & Growth of Capital |

| Invests in | Equity & Fixed Income Securities |

| Dividends | At managers discretion |

| Risk | Moderate |

| Taxation | Refer Government Tax policy |

| Trustee | National Savings Bank |

| Custodian | Bank of Ceylon |

| Management Fees | 1.650% P.A. |

| Trustee Fees | 0.250% P.A. |

| Custodian Fees | 0.085% P.A. |

| Front End Fee | 5% |

| Exit Fee | Nil |

| Minimum initial Investment | Rs 1,000/- |

| Currency | Sri Lanka Rupees (LKR) |

| Start Date | 1st March 1992 |

Introduction

Ceybank Unit Trust – Income and Growth Fund is the first Fund floated by CAML, in 1992. Ceybank Unit Trust has grown to become the largest unit trust Fund in the Income and Growth Fund category in Sri Lanka with more than 5,000 unit holders.

Objective

To achieve long term capital appreciation while enhancing income by investing in a diversified portfolio with mix of listed equity securities with strong growth potential and in Government and Corporate debt.

Style

The Fund Manager adopts an active portfolio strategy which places particular emphasis upon selecting under-valued equity and attractive fixed income securities. The Fund strives to diversify the equity investments across economic sectors and individual securities and fixed income investments between gilt-edged and corporate debt including cash equivalents.

Risk factors

Investing in Sri Lankan financial assets include the risk normally associated with investing in shares as well as country risk synonymous to Sri Lanka. Accordingly, the unit prices can fluctuate according to the value of the underlying investments. Since the investments are denominated in the local currency, the investors in other currencies would have to bear the currency risk as well.

Special Features

- Suitable for investors who seek income & capital growth

- Dividend distribution at managers discretion

- Less volatility than investing in one or few shares.

- Minimum investment is Rs 1,000/=

- Units can be redeemed at any time at the prevailing market price

- No Exit Fee

Taxation

Taxes payable by the Fund & the Investor will be based on the prevailing Government tax policy

Dividend

Dividend payable by the Fund is at the discretion of the manager

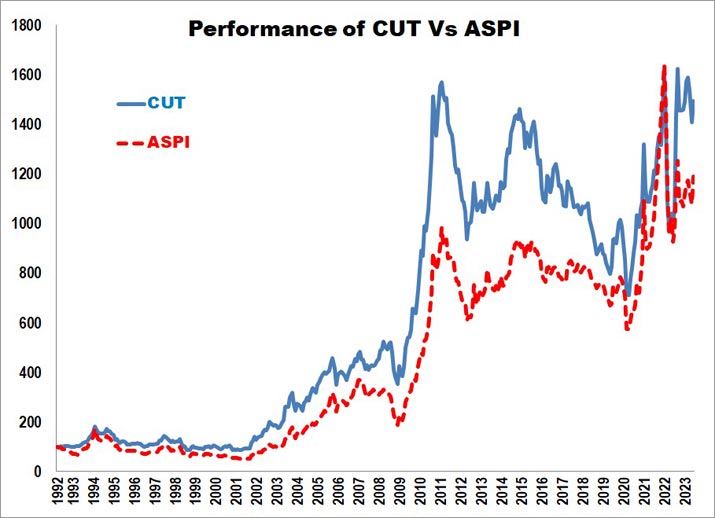

Performance of CUT VS All Share Index (ASI) since launch

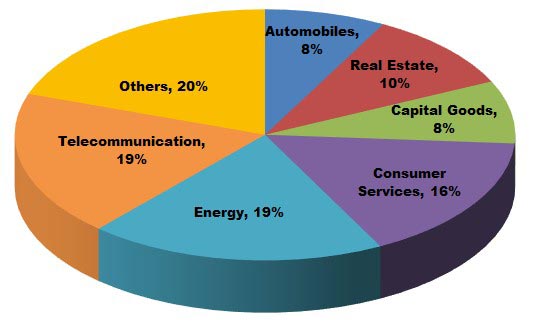

DIVERSIFICATION OF THE EQUITY PORTFOLIO

TOP TEN EQUITY HOLDINGS (Alphabetical Order) - CEYBANK UNIT TRUST

| Company |

|---|

| ASIAN HOTELS & PROPERTIES PLC |

| COLOMBO LAND & DEVELOPMENT COMPANY PLC |

| EQUITY TWO LTD |

| KELANI TYRES PLC |

| KELANI TYRES PLC |

| LANKA HOSPITALS CORPORATION PLC |

| LANKA IOC PLC |

| SRI LANKA TELECOM PLC |

| TRANS ASIA HOTELS PLC |

| VALLIBEL ONE PLC |

CUT Fund Performance based on NAV

| Simple Returns | ||

|---|---|---|

| Period | CUT | ASPI |

| 2022 | -0.96% | -30.56% |

| 2021 | 35.43% | 80.48% |

| 2020 | 10.12% | 10.52% |

| 2019 | 7.57% | 1.27% |

| 2018 | -11.37% | -4.98% |

| 2017 | -6.66% | 2.26% |

| 2016 | -7.97% | -9.66% |

| 2015 | -8.07% | -5.54% |

| 2014 | 33.78% | 23.44% |

| 2013 | 2.18% | 4.78% |

| 2012 | -12.30% | -7.10% |

| 2011 | -15.58% | -8.46% |

| 2010 | 96.80% | 96.01%v |

*Percentage change in NAV as at end December. Adjusted for dividends.

** ASPI - Colombo Stock Exchange All Share Index

| Fee Structure | |

|---|---|

| Front Load | 5.00% |

| Management Fee (p.a.) | 1.65% |

| Trustee & custodian Fee (p.a.) | 0.335% |

| Exit Load | Nil |

| Other Information | |

| Trustees | National Savings Bank |

| Custodian | Bank of Ceylon |

| Currency | Sri Lankan Rupees (LKR) |

| Minimum Initial Investment | LKR 1000 |

| Minimum Additional Investment | LKR 1000 |